Blog > Billing & Insurance > Clearinghouse Rejection vs Payer Denial: Differences, Causes & Prevention

Understanding Clearinghouse Rejections and Payer Denials in Mental Health Billing

Behavioral health providers accepting insurance often face claim rejections from clearinghouses or denials from payers due to coding errors, missing information, or coverage issues. Understanding the difference between rejections and denials helps providers prepare accurate claims and navigate the appeals process when necessary.

Last Updated: August 19, 2025

What You'll Learn

-

The key differences between clearinghouse rejections and insurance payer denials

-

Common reasons why insurance claims get rejected or denied by providers

-

How the appeals process works when claims are rejected or denied

-

Best practices to prevent claims from being rejected in the first place

If you are a therapist or another type of behavioral health professional, you know that accepting insurance can help you reach and work with more clients. Although taking insurance payments can expand your client base and allow you to provide more care to more people, doing so can also complicate the process of billing and receiving payment. Many behavioral health providers who take insurance use healthcare clearinghouses to process and send claims to insurance companies.

At some point along the way, it is possible for the claim you submit to be rejected or denied, either by the clearinghouse itself or by the insurance company, also known as the payer. Knowing the difference between a clearinghouse rejection and a payer denial can help you understand what you need to do if rejection or denial happens. Knowing why insurance claims get rejected also allows you to prepare clean claims, so they will be accepted the majority of the time.

What Is a Clearinghouse Rejection?

When your practice integrates a clearinghouse into its electronic health record (EHR) system, the clearinghouse reviews any claims you create before they are sent to a payer or insurance company. It's the clearinghouse's responsibility to "scrub" the claim, making sure it contains all of the correct information and that the codes you use are the correct ones.

If the clearinghouse notices that something is wrong with the claim, it will bounce it back to your practice for review and correction. A clearinghouse claim rejection can occur for a variety of reasons, such as:

- Zip code is out-of-state: The zip code for the patient or provider needs to be valid and must match the state the provider practices in or the state the client lives in. If the zip code isn't correct, the clearinghouse will reject the claim.

- Diagnosis code is invalid: A provider needs to input the correct diagnosis code for each client. In cases where there are multiple diagnoses, the diagnosis codes need to be put in in the appropriate order.

- Member ID is missing: Claims need to have the appropriate member identification number before they are sent to the insurance company.

- Referrer ID is missing: If a client was referred to your practice by another provider, you need to provide their ID on the claim.

- Payer ID is missing or incorrect: Claims need to have the correct payer ID listed. A clearinghouse will send back a claim if the ID is missing or typed incorrectly.

What Is a Payer Denial?

While a clearinghouse rejection comes from the intermediary and usually occurs because of an issue with medical coding or missing information, a payer denial occurs when the insurance company receives the claim, reviews it and decides not to pay it.

While a medical claim rejection typically occurs because of a typographical error or other easily fixable issues, mental health claim denials often occur because the payer or insurance company believes that it doesn't need to cover the service provided. Another reason for a payer denial is if the insurance company requires pre-certification or pre-authorization for a particular service and that pre-certification or authorization wasn't obtained.

In situations where a behavioral health provider doesn't use a clearinghouse to scrub or evaluate claims before they get sent to the payer, it's also possible for a payer to deny a claim due to a typo or data entry error. A payer can reject a claim if the subscriber information is inaccurate or if the billing codes used aren't correct.

Timeliness also matters when a provider submits a claim to a payer. Most insurance companies have filing deadlines and will reject claims submitted after those deadlines. If your practice isn't using a clearinghouse to submit claims, it's important to keep track of the deadlines for each of the payers you work with to make sure your claims aren't denied because they arrived too late.

What Percentage of Submitted Insurance Claims Are Rejected?

There is a considerable amount of variation in the number of insurance claims that are denied by payers.

Recent Insurance Claim Denial Statistics (2023–2025)

Variation in Denial Rates

-

In 2023, the rate of insurance claim denials showed significant variation by insurer and plan type, with in-network denial rates for ACA Marketplace plans ranging from as low as 1% to as high as 54% depending on the company and state.

-

The national average denial rate for in-network claims on the federal ACA Marketplace (HealthCare.gov) was 19% in 2023.

-

Out-of-network claims had a higher average denial rate of 37% in 2023

- Some insurers, such as UnitedHealthcare and AvMed, denied about a third of in-network claims, while others like Kaiser Permanente and Avera Health Plans had denial rates below 7%

Denial Rates by Plan Type (2023)

-

Employer-Sponsored Health Plans: 21% denial rate.

-

Marketplace Health Plans: 20% denial rate.

-

Medicare: 10% denial rate.

-

Medicaid: 12% denial rate.

State-Level Variation

-

Alabama had the highest average in-network denial rate among HealthCare.gov states at 34%, while South Dakota had the lowest at 6%.

-

Within states, the range for individual insurers can be even broader, with some companies denying more than half of all claims in certain states

Trends in 2024 and 2025

-

The initial denial rate on claims in 2024 increased to 11.8%, up 2.4% from the previous year, based on data from over 2,100 hospitals and 300,000 physicians.

-

Denials from commercial plans rose by 1.5%, while Medicare Advantage plans saw a 4.8% increase from 2023 to 2024.

-

More than half of denied claims (54.3%) by payers were ultimately overturned, but only after appeals.

One analysis of data from 2015 to 2017 found that the rate of rejections ranged from one percent of claims to more than 40 percent of claims, depending on the insurance company. On average, payers rejected 18 percent of claims in 2017.

When a claim is rejected, a provider and client have the option of appealing the rejection or denial. Appeals don't happen often, though. People who got their health insurance from the Affordable Care Act Marketplace appealed less than half of one percent of denied claims in 2017.

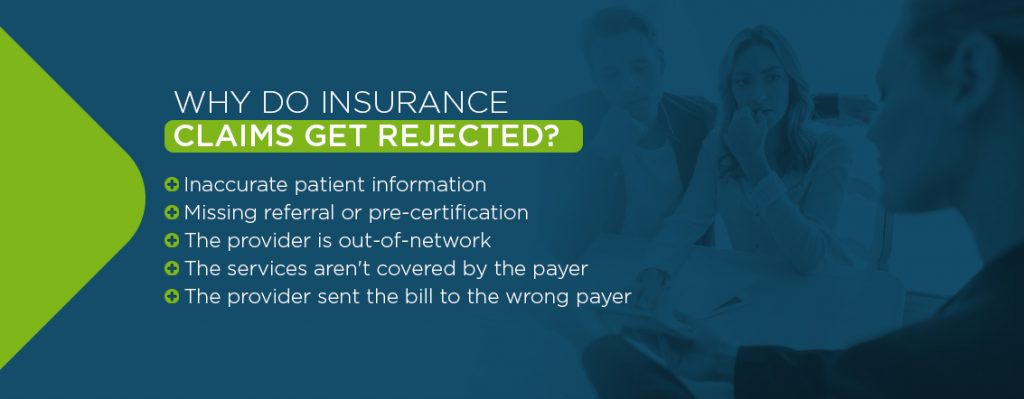

Why Do Insurance Claims Get Rejected?

Even if a claim makes it through the clearinghouse approval process and gets sent to an insurance company, it can still be denied by the insurance company. There are many reasons while a payer will deny a claim. In some cases, the denial is an easy thing to fix. Some of the more common reasons for rejections and denials include:

- Inaccurate patient information: All of the client's information needs to be correct and accurate for a payer to accept and pay a claim. If something is missing, if the client's name is misspelled or if their birthday isn't right, the payer can deny the claim.

- Missing referral or pre-certification: Depending on the type of insurance policy a client has, the payer might require referrals for certain behavioral health services, or it might require that certain services receive pre-authorization or pre-certification before it provides coverage.

- The provider is out-of-network: If your practice is out of the payer's network, it is likely not to provide coverage when a client comes to you.

- The services aren't covered by the payer: Although payers are required to provide mental health services coverage as of 2014, the coverage they offer can vary. The specific services a therapist or behavioral health professional provided to a client might not be covered by the client's health insurance.

- The provider sent the bill to the wrong payer: It's possible for a provider to bill the wrong insurance company for services given to a client. If that happens, the payer is more likely than not going to deny the claim.

What Is the Appeals Process?

The process of appealing a rejected or denied claim depends in large part on the reason the claim was rejected. If the issue was a simple typo, and it was rejected by the clearinghouse, your practice should correct the typo, make sure that all of the other information is correct and resubmit.

If the payer denied the claim, the appeals process can be more complex. Typically, the first step of the appeals process is for the client to request an internal review from the insurance company or payer. New paperwork needs to be submitted to the payer, including an appeals form. The team from the insurance company will review the appeal and decide whether to side with the client or with the payer.

If the internal review doesn't overturn the rejection or denial, the next step is to file an external appeal. During an external review, a third-party evaluates the claim and all relevant paperwork before deciding whether to uphold the rejection or overturn it. The decision of the external review team is final.

How to Prevent Mental Health Billing Claims From Being Denied or Rejected

Rejected or denied claims cost your therapy or behavioral health practice time and money. Knowing how to avoid claim rejection in the first place will help you avoid a considerable amount of headache and hassle. ICANotes' EHR software integrates with several third-party healthcare clearinghouses to help streamline and automate your claims submissions and to make sure your claims are accurate and correct before they get sent to the payer.

Request a free trial of ICANotes today to learn more about how our EHR system can help prevent insurance claims from being denied or rejected.

Schedule a Live Demo

Experience the most intuitive, clinically robust EHR designed for behavioral health professionals—built to streamline documentation, improve compliance, and enhance patient care.

- Simplify clinical charting

- Stay organized with appointment scheduling

- Reduce no-shows with automated reminders

- Improve client engagement with a secure patient portal

- Provide flexible care with HIPAA-compliant telehealth

Simplify clinical charting

Stay organized with appointment scheduling

Reduce no-shows with automated reminders

Improve client engagement with a secure patient portal

Provide flexible care with HIPAA-compliant telehealth

Frequently Asked Questions

Fatima C. Davis is the RCM Manager at ICANotes and a seasoned expert in behavioral health revenue cycle management. With over 20 years of experience, she specializes in optimizing collections, reducing denials, and ensuring compliance across diverse payer landscapes. Fatima has led RCM operations for large multi-agency systems and is passionate about helping behavioral health practices achieve financial sustainability.