Blog > Billing & Insurance > 99050 vs 99051 CPT Code: After-Hours Billing for Behavioral Health

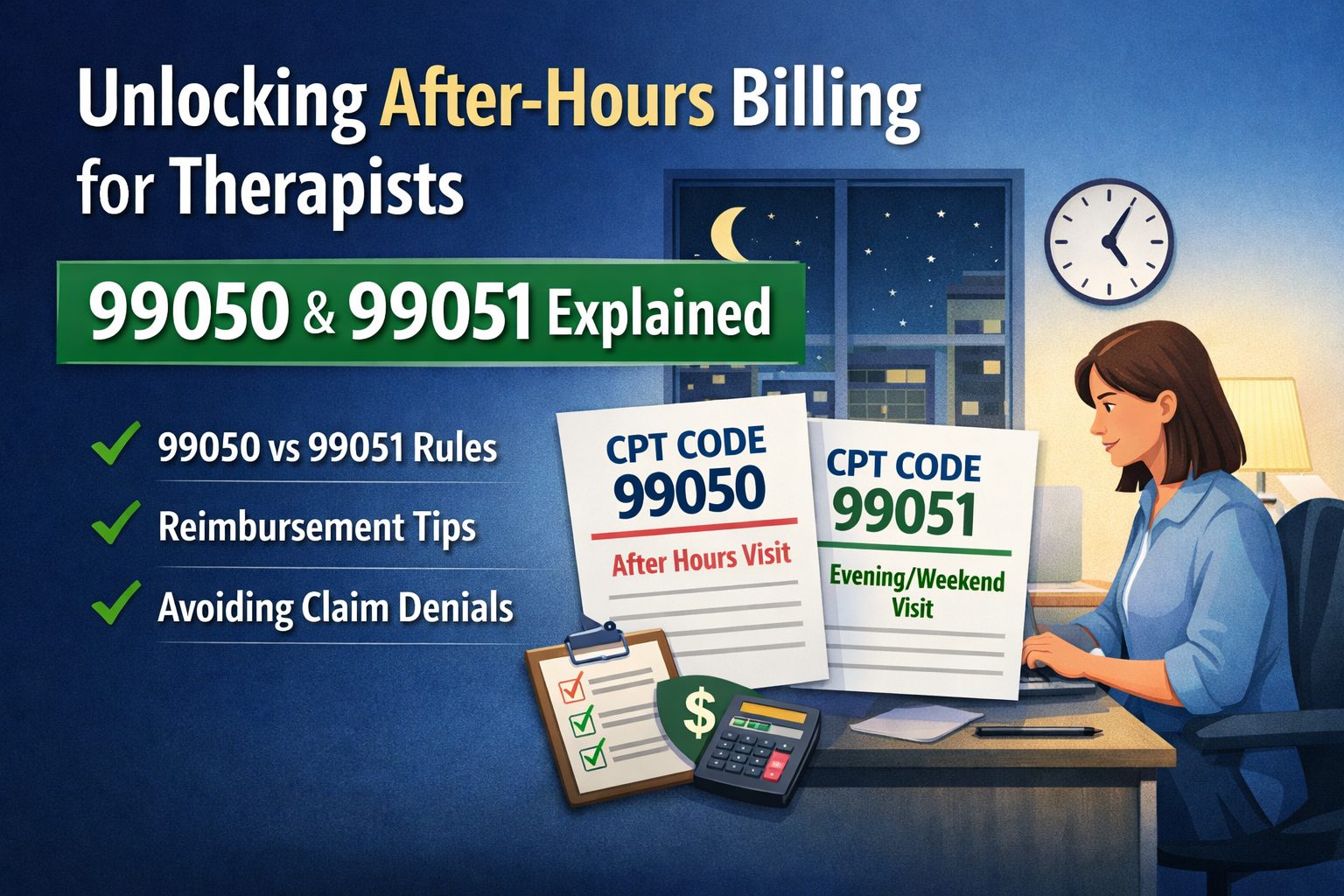

CPT Codes 99050 and 99051: How After-Hours Billing Works for Therapists

Behavioral health after-hours billing can be confusing, especially when deciding whether to use CPT code 99050 or 99051. This guide explains the difference between these after-hours CPT codes, when each applies based on posted office hours, and how insurers evaluate reimbursement. With real-world examples, documentation best practices, and payer-specific considerations, clinicians will learn how to bill 99050 and 99051 correctly, reduce denials, and stay compliant when providing therapy outside traditional business hours.

Last Updated: February 5, 2026

What You'll Learn

- Understand Code Differences: Learn the difference between CPT codes 99050 and 99051 for after-hours therapy sessions.

- Apply Correct Billing: See quick examples showing when to bill each code.

- Navigate Payer Rules: Know how insurance coverage and reimbursement differ between payers.

- Document Properly: Learn what details to record to stay compliant and avoid denials.

- Avoid Common Errors: Catch and prevent billing mistakes that lead to claim rejections.

- Leverage Technology: Discover how ICANotes simplifies and automates after-hours billing.

After-hours billing is one of the most confusing aspects of medical billing for behavioral health clinicians. Incorrect coding of after-hours sessions frequently leads to claim denials, delayed reimbursements, and compliance headaches. Whether you're seeing clients in the evenings, on weekends, or outside your posted office hours, understanding when to use CPT codes 99050 and 99051 is essential for accurate billing and proper reimbursement.

This comprehensive guide explains exactly when clinicians can use 99050 versus 99051, complete with real-world examples, documentation requirements, and practical billing strategies to reduce errors and maximize legitimate reimbursements.

What Are CPT Codes 99050 and 99051?

CPT codes 99050 and 99051 are add-on codes used to report services provided during times that fall outside standard business hours. Both codes are designed to compensate providers for the inconvenience and operational costs associated with seeing patients during non-traditional hours.

CPT 99050 is used for services provided at times other than regularly scheduled office hours, or when the office is otherwise closed for business. This typically applies when a provider opens their office specifically to accommodate a patient outside normal hours.

CPT 99051 is used for services provided during regularly scheduled evening, weekend, or holiday office hours. This code applies when your practice maintains posted hours that include these non-traditional times.

Both codes are add-on codes, meaning they must be billed in addition to a primary therapy CPT code such as 90834 (45-minute psychotherapy), 90837 (60-minute psychotherapy), or other evaluation and management services. They cannot be billed alone and typically apply to in-office sessions, though telehealth rules vary by payer.

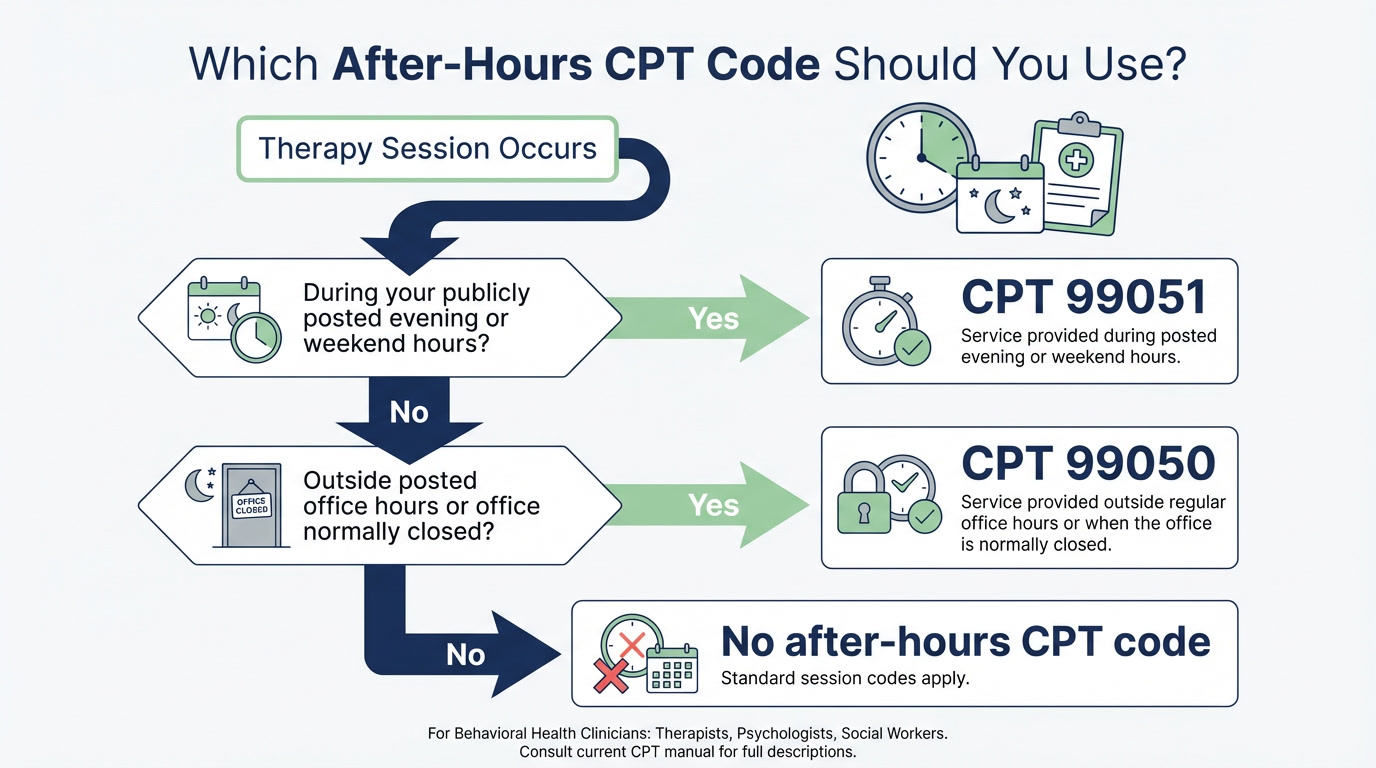

99050 vs 99051: Key Differences

Understanding the distinction between these two codes is critical for proper billing. The key difference lies in whether the service occurs during your posted office hours or outside of them.

Important clarifications:

- Evening" generally means after 5:00 PM for most insurance payers, though some define it as after 6:00 PM

- Your office hours must be publicly posted and readily accessible to patients (website, door signage, online directories)

- The determination is based on when the session occurs, not when it was scheduled

Free 2026 Billing Guide for Mental Health Providers

Clean claims. Correct coding. Fewer denials.

This comprehensive guide breaks down everything you need to bill accurately, reduce denials, and protect your revenue. Download your copy and get the tools you need to streamline billing and boost reimbursement.

When Therapists Can Use After-Hours CPT Codes (With Examples)

Let's break down specific scenarios to clarify when each code applies.

Use CPT 99050 when:

- The session occurs outside your posted office hours

- Your office is normally closed at the time of service

- You're seeing a patient on a holiday when your office is typically closed

Use CPT 99051 when:

- The session occurs within your publicly listed evening, weekend, or holiday hours

- Your practice regularly operates during these non-traditional times and this is advertised

Real-World Examples:

- Scenario 1: Your posted hours are 9 AM to 5 PM. You see a client at 6 PM. → Use 99050 (outside posted hours)

- Scenario 2: Your posted hours are 11 AM to 7 PM. You see a client at 6 PM. → Use 99051 (within posted evening hours)

- Scenario 3: Session starts at 4:30 PM and ends at 5:30 PM, with posted hours of 9 AM to 5 PM. → No after-hours code (session began during business hours)

- Scenario 4: You see a client on Sunday and your office is normally closed on Sundays. → Use 99050 (office closed)

- Scenario 5: Your posted hours include Saturdays from 10 AM to 2 PM, and you see a client at 11 AM on Saturday. → Use 99051 (within posted weekend hours)

Insurance Reimbursement: Do Payers Cover 99050 or 99051?

One of the biggest frustrations for clinicians is that many insurance payers do not automatically reimburse for after-hours codes, even when they're billed correctly. Reimbursement depends heavily on your contracts and the specific payer's policies.

Medicare and Medicaid:

Medicare and most state Medicaid programs do not reimburse for CPT codes 99050 or 99051. These codes are considered bundled into the primary service payment and are not separately payable under federal guidelines. Some state Medicaid programs may have exceptions, so always verify with your state's fee schedule.

Commercial Insurance:

Commercial payer reimbursement varies widely. Some insurers reimburse these codes automatically, some require pre-authorization or specific contract language, and others deny them outright. Without explicit coverage in your provider contract, you may see frequent denials.

What clinicians should do:

- Review your payer contracts carefully to see if after-hours codes are covered

- Get payer confirmation in writing before routinely billing these codes

- Track denial patterns and adjust your billing strategy accordingly

- Consider private-pay surcharges for after-hours sessions if insurance doesn't reimburse (ensure this is compliant with your contracts)

Billing and Documentation Requirements

Proper documentation is essential to support after-hours billing and defend against audits or claim disputes. Inadequate documentation is one of the most common reasons for denials.

Required documentation elements:

- Session start and end times: Document the exact time the session began and ended

- Posted office hours: Note what your posted hours were on the date of service

- Reason for after-hours service: Some payers require documentation explaining why the session occurred outside normal hours (patient work schedule, clinical necessity, etc.)

- Location of service: Specify whether the session was in-office or via telehealth

- Add-on billing notation: Confirm that the code was billed as an add-on to a primary therapy code (e.g., 90837 + 99050)

A complete clinical note should clearly show that the session met the criteria for after-hours billing. If your documentation doesn't explicitly show the timing and justification, expect denials or recoupments during audits.

Common Billing Mistakes to Avoid

Even experienced clinicians make errors when billing after-hours codes. Here are the most common mistakes and how to avoid them:

- Using codes for telehealth when the payer doesn't allow it: Many insurers restrict after-hours codes to in-office services only. Always verify telehealth eligibility before billing.

- Billing when the session ran late but didn't start after hours: If a session begins at 4:30 PM and your office closes at 5:00 PM, you cannot bill an after-hours code just because it ended late.

- Not posting office hours publicly: Payers may request proof of your posted hours during audits. Make sure your hours are clearly displayed on your website, Google Business profile, and office signage.

- Using codes without payer confirmation: Don't assume your contract covers these codes. Get written confirmation from each payer before billing.

- Billing for "last-minute" or "urgent" appointments: After-hours codes are not for same-day appointments or urgency—they're strictly for timing outside posted hours.

- Inconsistent posted hours: If you frequently change your hours without updating public-facing information, payers may deny claims for inconsistency.

Can You Bill After-Hours Codes for Telehealth?

This is one of the most frequently asked questions about after-hours billing, and the answer is: it depends on the payer.

The CPT manual itself does not explicitly prohibit using 99050 or 99051 with telehealth services. However, many insurance payers have implemented their own restrictions that limit after-hours codes to in-person services only.

Common payer rules:

- Some payers allow after-hours codes for telehealth without restriction

- Some allow them only if the clinician is physically present in the office during the telehealth session

- Many do not reimburse after-hours codes for telehealth at all

Always verify telehealth policies with each payer before billing after-hours codes for virtual sessions. This is especially important as payer policies continue to evolve post-pandemic.

How ICANotes Helps Clinicians Bill After-Hours Sessions Accurately

Billing after-hours codes accurately requires precise documentation, timing records, and CPT code selection. This is where ICANotes provides significant value to behavioral health practices.

Key features that support after-hours billing:

- Correct CPT code selection: ICANotes guides clinicians through proper CPT code selection based on service type and timing, reducing the risk of coding errors.

- Built-in audit trail: Every note includes a complete audit trail that documents when sessions occurred, helping you defend claims during audits or disputes.

- Accurate timestamping: The system automatically captures session start and end times, ensuring your documentation aligns with your billing.

- Add-on code billing support: ICANotes makes it easy to append add-on codes like 99050 and 99051 to primary therapy codes, preventing standalone billing errors.

- Reduces coding errors and denials: By providing clear documentation prompts and billing support, ICANotes helps practices minimize claim denials related to after-hours services.

For behavioral health clinicians who frequently see clients outside traditional business hours, having an EHR system that supports accurate after-hours billing is essential for maintaining cash flow and reducing administrative burden.

See how ICANotes supports accurate behavioral health billing

If after-hours sessions are part of your practice, having documentation and billing workflows that hold up under payer scrutiny matters. ICANotes helps clinicians create clear, audit-ready notes and bill correctly — even for complex scenarios like evenings and weekends.

Start a free trial of ICANotes and explore how it fits your workflow.

Start Your 30-Day Free Trial

Experience the most intuitive, clinically robust EHR designed for behavioral health professionals, built to streamline documentation, improve compliance, and enhance patient care.

- Complete Notes in Minutes - Purpose-built for behavioral health charting

- Always Audit-Ready – Structured documentation that meets payer requirements

- Keep Your Schedule Full – Automated reminders reduce costly no-shows

- Engage Clients Seamlessly – Secure portal for forms, messages, and payments

- HIPAA-Compliant Telehealth built into your workflow

Complete Notes in Minutes – Purpose-built for behavioral health charting

Always Audit-Ready – Structured documentation that meets payer requirements

Keep Your Schedule Full – Automated reminders reduce costly no-shows

Engage Clients Seamlessly – Secure portal for forms, messages, and payments

HIPAA-Compliant Telehealth built into your workflow

Frequently Asked Questions: 99050 and 99051 CPT Codes

Billing 99050 and 99051: Key Takeaways for After-Hours Therapy Sessions

Billing after-hours codes correctly requires a clear understanding of CPT guidelines, payer policies, and documentation best practices. By mastering the distinction between CPT codes 99050 and 99051, maintaining accurate records of your posted hours, and using tools like ICANotes to support proper billing, you can maximize legitimate reimbursements while minimizing claim denials and audit risks.

Remember: always verify coverage with your specific payers, document every after-hours session thoroughly, and keep your posted hours consistent and publicly accessible. With the right approach, after-hours billing can become a straightforward part of your practice's revenue cycle rather than a source of confusion and denials.

Related Posts

About the Author

Racheal Morris is a certified medical coder and biller with over 15 years of experience in behavioral health settings. As an RCM Account Manager at ICANotes, she ensures that our customers' billing, claims, and reimbursement processes run smoothly, efficiently, and compliantly — and that revenue is maximized with minimal delays or denials.